If you're looking for a way to diversify your retirement savings, hedge against inflation, and secure your wealth for the long term, a Physical Gold IRA might be exactly what you need.

But before you start rolling over your 401k or buying physical gold, it's important to understand exactly how these accounts work.

In this article, we'll walk you through everything you need to know about investing in a Physical Gold IRA, including storage options, fees, the advantages of holding physical gold over other types of gold investments, and how to pick the right custodian. Let's dive in!

What Is a Physical Gold IRA?

A Physical Gold IRA is a type of self-directed Individual Retirement Account (IRA) that allows you to own physical gold (and other IRS-approved precious metals) as part of your retirement savings.

Unlike traditional IRAs that typically invest in stocks, bonds, and mutual funds, a Physical Gold IRA holds tangible assets like gold bars or coins.

A Physical Gold IRA gives you the ability to buy, hold, and store actual gold and other precious metals, offering security and diversification for your retirement portfolio.

Why Invest in a Physical Gold IRA?

You're probably wondering why you would want to invest in physical gold through an IRA. Let's break it down:

Hedge Against Inflation

Gold has historically acted as a hedge against inflation. As the value of paper currency declines, the price of gold often rises. When inflation spikes, holding physical gold in your IRA can help preserve your purchasing power.

Diversification

A well-diversified portfolio is key to minimizing risk. Gold behaves differently than stocks and bonds, which means it can offer stability during times of economic uncertainty. By adding physical gold to your IRA, you diversify your retirement savings, reducing your exposure to market volatility.

Long-Term Preservation of Wealth

Gold has been a store of value for thousands of years. Unlike paper assets, which can lose value due to inflation or market volatility, physical gold holds intrinsic value. It's a tangible asset that won't go to zero, providing peace of mind for long-term investors.

How Does a Physical Gold IRA Work?

A Physical Gold IRA functions similarly to a traditional IRA, but with a few key differences:

1. Self-Directed

You'll need a self-directed IRA to hold physical gold. This type of IRA allows for alternative investments, like real estate or precious metals, alongside traditional investments.

2. IRS-Approved Precious Metals

Not all gold or precious metals are allowed in a Gold IRA. The IRS has strict guidelines on the types of metals you can hold. These include:

- Gold (99.5% purity or higher)

- Silver (99.9% purity or higher)

- Platinum (99.95% purity or higher)

- Palladium (99.95% purity or higher)

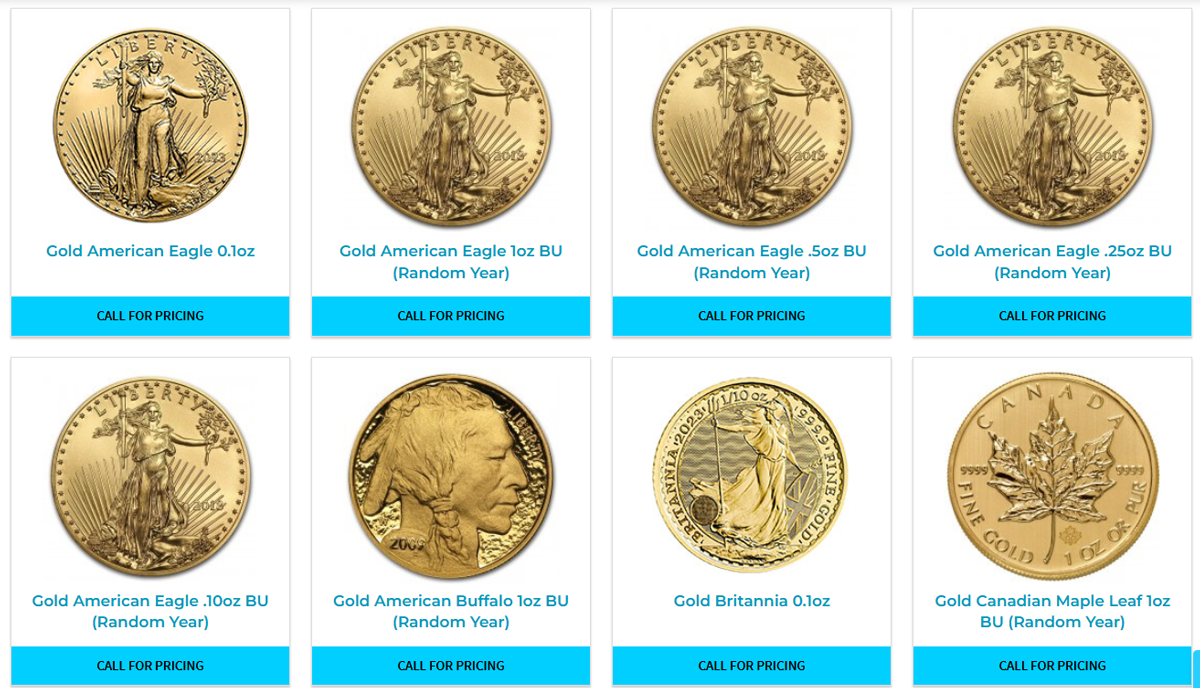

Examples of approved gold include American Gold Eagle Coins, Canadian Gold Maple Leaf Coins, and gold bars from approved refiners.

4. Custodian Required

You can't store the gold yourself. You'll need an IRS-approved custodian to manage the account and handle the storage of your physical gold. More on this later.

How to Buy Physical Gold With a 401k

If you already have a 401k and want to buy physical gold, you can do so by rolling over your 401k into a Physical Gold IRA. Here's a quick look at the process:

Step 1: Open a Self-Directed IRA

First, you'll need to open a self-directed IRA with a custodian that allows investments in physical gold.

2. Step 2: Initiate a 401k Rollover

If your 401k is from a previous employer, you can roll it over into your new Gold IRA. If your 401k is with your current employer, you may need to check if an in-service rollover is allowed.

3. Step 3: Buy IRS-Approved Gold

Once your rollover is complete, you can direct your custodian to purchase IRS-approved gold on your behalf.

Note: This process can be done without triggering taxes or penalties if done correctly.

Storage Options for Your Physical Gold IRA

When you invest in a Physical Gold IRA, you can't store the gold in your own house or a personal safe. The IRS requires that the gold be stored in an approved depository. Here are your storage options:

1. Segregated Storage

In a segregated storage arrangement, your gold is stored separately from other investors' assets. This means the exact gold coins or bars you purchase are kept in a dedicated vault space with your name on it.

When it comes time to withdraw or sell, you get the same gold that you originally invested in.

Pros: Greater peace of mind knowing your gold is stored separately.

Cons: Typically comes with higher storage fees.

2. Commingled Storage

With commingled storage (non-segregated), your gold is stored with other investors' assets. While you still legally own a portion of the gold in the vault, specific coins or bars may not be individually assigned to you.

Pros: Lower storage fees.

Cons: You won't get the exact gold you purchased when you withdraw; instead, you'll get an equivalent amount of gold.

Important Note: Always ensure your custodian works with reputable depositories that provide full insurance and security for your assets.

Fees to Expect with a Physical Gold IRA

While a Physical Gold IRA offers many benefits, it does come with some costs that you won't encounter with a traditional IRA. Here are the common fees you should be aware of:

1. Account Setup Fees

When you open a self-directed IRA, there's usually a one-time setup fee ranging from $50 to $250, depending on the provider.

2. Annual Maintenance Fees

Custodians charge an annual maintenance fee, typically between $75 and $300, to manage your IRA and maintain records.

3. Storage Fees

Since the IRS requires that your physical gold be stored in an approved depository, you'll need to pay storage fees.

These range from 0.5% to 1.0% of your account value per year, depending on whether you choose segregated or commingled storage.

4. Transaction Fees

Each time you buy or sell gold within your IRA, there may be transaction fees. These can range from $25 to $100 per transaction.

💡Pro Tip: Be sure to ask your custodian for a full breakdown of fees before opening your account. Transparent fee structures are a good indicator of a reputable provider.

How to Choose a Gold IRA Custodian

A crucial step in setting up your Physical Gold IRA is choosing the right custodian. Since the custodian will handle the management, purchasing, and storage of your gold, it's important to pick one you can trust.

What to Look For in a Custodian:

1. Reputation and Experience

Look for custodians with a strong reputation in the industry. Check online reviews, ratings from independent organizations like the Better Business Bureau (BBB), and customer testimonials.

2. Fee Structure

Make sure the fee structure is clear and transparent. Hidden fees or complicated pricing can quickly eat into your returns.

3. Storage Options

Ensure the custodian works with IRS-approved depositories and offers both segregated and commingled storage options.

4. Customer Service

The custodian should provide excellent customer service. This includes educating you on your investment, handling your questions promptly, and offering guidance throughout the process.

Popular Gold IRA Companies

Here are a few well-known companies in the Physical Gold IRA space who work with the reputable custodians:

- Augusta Precious Metals: Offers extensive education for investors and transparent fee structures.

- Goldco: Known for excellent customer service and competitive pricing.

- Birch Gold Group: Provides a streamlined process for setting up a Gold IRA with a focus on customer satisfaction.

Advantages of Physical Gold Over Other Gold Investments

You might be asking, Why invest in physical gold instead of gold ETFs or mining stocks? Here are some key advantages of holding physical gold in your IRA:

1. Tangible Asset

Unlike gold ETFs or mining stocks, physical gold is a tangible asset. You own something you can physically hold, which offers peace of mind during economic downturns.

2. No Counterparty Risk

With physical gold, you don't have to worry about the performance of a company or fund manager. Your investment isn't dependent on a third party's actions.

3. Intrinsic Value

Physical gold has intrinsic value, unlike paper assets, which can lose value due to poor market performance. Gold has been a reliable store of value for centuries.

Is a Physical Gold IRA Right For You?

A Physical Gold IRA can be an excellent way to diversify your retirement portfolio and protect your savings against inflation and market volatility. However, it's not for everyone. Here are a few factors to consider before making the leap:

- Investment Time Horizon: Gold tends to perform well over the long term, so it's best suited for those with a long investment horizon.

- Portfolio Diversification: If you already have a well-diversified portfolio, adding 5%-15% of your retirement savings to gold can further reduce risk.

- Risk Tolerance: Gold is generally considered a safe-haven asset, but its price can still fluctuate. Ensure you're comfortable with that level of risk.

Final Thoughts

Investing in a Physical Gold IRA can offer significant benefits, from protecting against inflation to providing long-term wealth preservation.

However, it's essential to understand the fees, storage requirements, and the role of your custodian before diving in.

If you're ready to diversify your portfolio and secure your retirement savings with physical gold, make sure to choose a custodian who will guide you through the process and keep your investments safe.

By taking these steps, you'll be well on your way to building a more resilient retirement portfolio—one that's backed by the timeless value of gold.

Ready to get started? Explore our recommended Gold IRA companies to find the right fit for your investment needs.