Are you nearing retirement and looking to diversify your portfolio beyond traditional stocks, bonds, and mutual funds?

Converting part or all of your IRA to physical gold may provide portfolio stability, inflation protection, and increased financial security in your golden years.

This guide will walk you through the process of converting your IRA to gold in 6 easy steps. You’ll learn the benefits of a Gold IRA, how to transfer funds from your existing IRA, the gold products allowed in an IRA, and more.

With this knowledge, you can make the most informed decision on whether a Gold IRA aligns with your retirement investment goals.

What is a Gold IRA?

A Gold IRA, also known as a Precious Metals IRA, is a self-directed Individual Retirement Account that allows you to hold physical gold and other IRS-approved precious metals.

This includes gold, silver, platinum, and palladium in the form of coins and bullion.

Gold IRAs function similarly to traditional IRAs, except your account is backed by tangible assets rather than paper investments. All the same IRA tax benefits apply for contributions and distributions.

The key differences lie in how the account is funded and the types of assets held within it.

A Gold IRA provides the following key benefits:

- Portfolio diversification beyond paper assets

- A hedge against inflation and financial crises

- Tax-advantaged growth potential

- Greater control over retirement savings

Adding physical precious metals to your overall retirement portfolio is smart diversification. Gold often moves independently of stocks and bonds, helping mitigate losses when paper assets decline.

It also carries intrinsic value, unlike fiat currency, which is prone to inflationary erosion over time.

5 Reasons to Consider Converting Your IRA to Gold

Here are five compelling reasons why transferring funds from your existing IRA into physical gold may be a savvy retirement planning move:

1. Protection from Inflation

Inflation erodes the purchasing power of traditional IRAs invested in paper assets.

When inflation rises, a fixed dollar amount buys less and less goods and services over time. Gold has historically maintained its value better than currency, acting as an inflation hedge.

2. Mitigation of Market Volatility

Stocks, bonds, and mutual funds are vulnerable to market swings and loss of value, especially during recessions and periods of volatility.

Gold often performs well when paper investments decline, helping stabilize an overall portfolio.

3. Preservation of Wealth

Gold has served as real money and a reliable store of value for millennia.

Unlike paper assets, tangible gold cannot go to zero, helping preserve retirement savings in any economic climate.

4. Tax Benefits

If set up correctly, a gold IRA provides the same tax perks as a traditional IRA. These include tax-deferred growth and potentially tax-free withdrawals later in retirement.

5. Greater Financial Security

Holding a tangible asset like physical gold provides a sense of security and empowers you to take greater control of your financial destiny. This is especially helpful during times of economic uncertainty.

Is a Gold IRA the Right Choice for You?

Converting part or all of your IRA to physical gold isn’t necessarily the right choice for everyone.

Here are a few key factors to consider when weighing a Gold IRA:

- Your age and proximity to retirement

- Total size of your retirement portfolio

- Your risk tolerance

- Existing diversity of retirement investments

- Investment time horizon

- Interest in a tangible, non-paper asset

Younger investors with an aggressive risk tolerance may opt to maximize stock market returns over the long run.

Those nearing retirement who want to play it safer may prefer mitigating risk with gold. Most retirees hold some stocks and some gold for balanced exposure.

Work with a financial advisor to determine your specific asset allocation needs. Many choose to convert a portion (5%-30%) of IRA funds to gold as part of a prudent diversification strategy.

How to Convert an IRA to Gold in 6 Steps

If you decide moving forward with a Gold IRA aligns with your retirement investment objectives, here is an outline of the conversion process in six straightforward steps:

Step 1: Choose a Gold IRA Company

Like any investment firm, not all Gold IRA companies are created equal. You want to choose a reputable company with a strong track record, competitive pricing, and excellent customer service.

Experienced Gold IRA specialists will seamlessly handle setting up your account, executing a transfer or rollover, purchasing approved metals, and arranging insured storage at an accredited depository. This expertise and hand-holding is well worth the price.

Below are some of the top Gold IRA companies to consider:

Augusta Precious Metals

Augusta Precious Metals is likely your best option for investors with $50,000 or more to fund a Gold IRA.

Their premium services justify the higher account minimum. Customers rave about their educational resources and responsive support throughout the conversion process.

Goldco

Goldco is an excellent choice for investors who desire a streamlined Gold IRA setup. Competitive pricing and strong customer satisfaction ratings make Goldco a trusted partner for executing a seamless IRA conversion.

American Hartford Gold

American Hartford Gold is known for a streamlined IRA rollover process, above-average customer service, and a wide variety of IRA-approved gold and silver coins and bars. It is ideal for investors who value guidance and metal selection.

Step 2: Open a Self-Directed Gold IRA

Once you choose a partner Gold IRA company, it’s time to open a special self-directed IRA account to receive your gold.

This functions like a traditional IRA, except you have greater flexibility with non-traditional investments beyond stocks and bonds.

Your Gold IRA company will help open an account with an IRS-approved custodian.

Step 3: Fund Your Gold IRA

Now it’s time to transfer money from your existing IRA or qualified retirement plan into your new self-directed Gold IRA account.

You have two options: a direct rollover or a transfer.

With a direct rollover, your current IRA custodian sends funds directly to your new IRA custodian. The funds move trustee-to-trustee, so you never personally take possession.

A transfer means you physically receive a distribution from your old IRA and must deposit those funds into your new account within 60 days.

Direct rollovers are usually preferred to avoid touching the money.

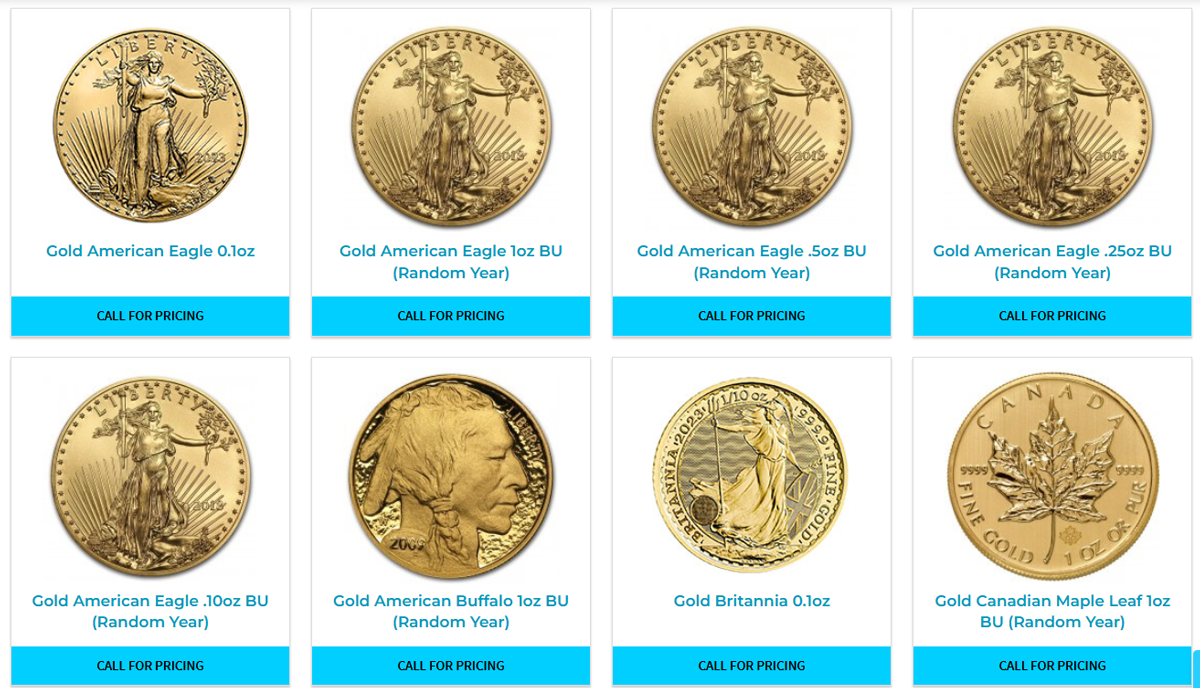

Step 4: Buy IRS-Approved Gold & Silver

Once your new Gold IRA account is funded, it’s time to purchase physical precious metals! You will direct your custodian to buy gold, silver, platinum, or palladium products that meet IRS requirements:

- Gold Coins: American Gold Eagles, Canadian Gold Maple Leafs, American Gold Buffalo

- Gold Bullion: Bars, rounds, ingots (.995+ pure)

- Silver Coins: American Silver Eagles, Canadian Silver Maple Leafs

- Silver Bullion: Bars, rounds, ingots (.99+ pure)

- Platinum Coins and Bullion: (.9995+ pure)

- Palladium Coins and Bullion: (.9995+ pure)

Your Gold IRA company will ensure you purchase eligible gold and silver products that align with IRS regulations for purity, weight, and metal content.

Buying the right products keeps your Gold IRA compliant.

Step 5: Store Your Metals at an IRS-Approved Depository

Once you purchase metals for your Gold IRA account, they must be stored at an IRS-approved depository facility to maintain tax compliance.

These specialized facilities provide maximum security for your physical gold assets.

Off-site storage also ensures your metals are insulated from any financial or legal liabilities. Your Gold IRA precious metals are not directly tied to you or your business.

Leading Gold IRA custodians partner with the top depositories like Delaware Depository and Brinks.

Step 6: Monitor Your Gold IRA

The final step is monitoring your precious metals investments within your Gold IRA over time. You’ll receive regular account statements detailing your holdings and their estimated market value.

Periodically rebalance your Gold IRA by selling off or buying more coins and bullion to maintain your ideal asset allocation between gold, silver, stocks, bonds, etc.

Work closely with your Gold IRA custodian to execute these transactions seamlessly.

The Gold IRA Rollover Process Explained

Exchanging all or part of an existing IRA into a Gold IRA is called a Gold IRA rollover.

It simply means transferring IRA funds or assets from your current custodian to a new self-directed IRA custodian that allows holding physical precious metals.

These are the two common types of Gold IRA rollovers:

Direct Rollover (aka Trustee-to-Trustee Transfer)

With a direct Gold IRA rollover, your current IRA custodian transfers funds directly to your new Gold IRA custodian on your behalf.

You never take possession of the money. It moves straight from custodian to custodian for a seamless transition.

There are no IRS rules against unlimited direct IRA rollovers in a year. The direct rollover path avoids potential taxes or penalties that may apply if you personally withdrew IRA funds.

Indirect Rollover

In an indirect rollover, you first authorize your old IRA custodian to distribute funds directly to you.

Once you receive the money, you have 60 days from that date to deposit those funds into your new Gold IRA account to avoid penalty.

If you miss the 60-day window, you’ll face a 10% early withdrawal penalty if you are under age 59 1⁄2. You can only do one indirect IRA rollover per 12-month period to avoid penalty.

A direct rollover is usually the best way to avoid taxes or penalties on moving funds from an existing IRA to a new self-directed Gold IRA account.

401k to Gold IRA Rollover

Can you transfer funds from a 401k plan to a Gold IRA tax-free? Generally, yes. The 401k rollover rules to gold largely mirror IRA rollover rules.

If executed properly, you can rollover funds from your current 401k, 403b, or TSP retirement account into a self-directed Gold IRA without tax penalty.

A direct 401k-to-Gold IRA rollover is optimal. You can roll over the entire balance or a portion of funds as desired.

One key caveat is if your current employer offers a 401k match. In that case, it likely makes sense to keep contributing to the 401k up to the full employer match before rolling anything over to gold. That free matching money outweighs any Gold IRA benefits.

Always consult a financial advisor and tax professional before initiating any 401k rollover to ensure it aligns with your financial situation and retirement investment goals.

Gold IRA Tax Rules & Reporting Requirements

The IRS treats Gold IRAs like any other IRA when it comes to taxation. This means you receive the same tax advantages during accumulation years and distribution in retirement.

But there are reporting requirements and distribution rules to understand:

Tax-Deferred Growth

Like a traditional IRA, Gold IRAs benefit from tax-deferred growth on earnings.

You avoid paying taxes on capital gains and income generated annually within the account. Taxes only apply on eventual withdrawals. Any growth of your gold’s value accumulates free of current tax.

Tax-Free Withdrawals

Qualified Gold IRA withdrawals after age 59 1⁄2 mirror traditional IRA withdrawals. Once you reach this retirement age threshold, distributions are taxed as ordinary income. The same income tax rates and rules apply.

Early Withdrawal Penalties

With a traditional Gold IRA, cashing out funds before age 59 1⁄2 results in the same 10% early withdrawal penalty that applies to any IRA funds taken out early. Limited exceptions apply.

Required Minimum Distributions (RMDs)

The IRS mandates you start taking Required Minimum Distributions (RMDs) out of all traditional IRAs after age 72 to avoid steep penalties.

The same RMD rules apply to traditional Gold IRAs. Distributions must start by April 1, following the year you reach age 72.

Annual Reporting

While a Gold IRA provides the same tax benefits during accumulation, there are annual reporting requirements. The IRS requires strict record-keeping of transactions. You must file IRS Form 5498 detailing contributions and Form 1099-R for withdrawals.

Gold IRAs provide tax advantages if set up and used properly. Work closely with your custodian to fully comply with any IRS reporting responsibilities.

Gold IRA Fees

Opening and maintaining a Gold IRA does come with account fees and expenses beyond a typical IRA.

Make sure you understand any fees associated with your Gold IRA provider, administration, transactions, and precious metals storage.

Typical Gold IRA fees include:

- Set Up Fees: $50 to $250 to establish a new Gold IRA account. Fees may be waived above certain investment minimums.

- Annual Fees: $150 to $300 charged yearly to maintain the account, regardless of its value.

- Storage Fees: Ranges from 0.5% to 2% of assets annually. Higher-valued accounts pay less as a percentage.

- Transaction Fees: $25 to $100 each time you buy or sell metals.

- Custodian Transfer Fee: $25 to $100 to move gold from one depository to another.

When comparing Gold IRA companies, look closely at their fee structure. Custodians offer competitive pricing to earn your business. Larger investment amounts can sometimes lower proportional fees.

Shopping around helps you select a cost-efficient Gold IRA provider that fits your investment objectives. Protecting your hard-earned retirement money should be the priority.

Gold IRA Drawbacks to Consider

While the benefits often outweigh the downsides, there are some potential drawbacks to evaluate before establishing a Gold IRA:

1. Limited Short-Term Growth Potential

The value of physical gold may not increase significantly over shorter time horizons. The price fluctuates but is unlikely to rapidly appreciate.

If your investment time horizon is decades, this is less concerning. Gold’s strength lies in long-term stability.

2. No Income Generation

Since physical gold does not pay interest or dividends, your Gold IRA does not create current income.

Paper assets like bonds and dividend stocks have that advantage. But gold’s lack of cash flow is offset by capital preservation.

3. Inflexibility of Physical Assets

Once you fund a Gold IRA, your money is locked into an illiquid, physical asset. You can’t freely trade gold bullion like stocks or bonds.

Selling and buying coins or bars back from dealers takes more time and comes with higher transaction costs.

4. Required Use of Custodian & Depository

The mandated use of custodians and depositories for holding Gold IRA assets also limits flexibility while adding fees. You rely on these third parties for all transactions and access to your metals.

5. IRS Reporting Requirements

More rigorous IRS reporting rules apply that don’t exist for standard IRAs invested in stocks and bonds. Recordkeeping for all Gold IRA transactions is essential for compliance.

Based on your retirement investing objectives, time horizon, portfolio composition, and risk tolerance, determine whether the pros outweigh any cons.

For many, the advantages of a Gold IRA win out.

Gold IRA Frequently Asked Questions (FAQs)

Here are answers to some common questions regarding Gold IRAs.

Can I Convert My Entire IRA to Gold?

Yes, converting your entire IRA to physical precious metals is technically possible. There are no IRS rules capping gold exposure at a certain percentage. However, most financial advisors caution against putting all your eggs in one basket.

Maintaining some exposure to paper assets while diversifying a portion (10%-30% commonly recommended) into gold is generally ideal for balanced risk management.

What is the Best Gold IRA Allocation?

Most advisors suggest dedicating 5%-30% of retirement account assets to physical gold and silver as part of a diversified portfolio. Such exposure helps stabilize overall returns while mitigating against inflation and market volatility.

Ultimately, what allocation percentage makes sense depends on your risk tolerance and time horizon until retirement. Work with a financial advisor to determine your optimal asset allocation split.

Can I Store my Gold IRA at Home?

Unfortunately no. IRS rules mandate Gold IRA metals be stored at an approved depository custodial facility.

Most leading Gold IRA companies partner with highly reputable and insured storage options like Brinks, Delaware Depository, and IDS of Texas to hold your gold securely on your behalf.

Does Gold IRA Investment Increase Taxes?

If you properly set up and use a Gold IRA, you receive the same tax advantages during accumulation years as a traditional IRA.

The account grows tax deferred, and withdrawals in retirement are taxed as ordinary income. No special Gold IRA taxes apply.

Converting Your IRA to Physical Gold: The Final Take

Deciding whether to convert your existing IRA or 401k to physical gold requires careful consideration of the pros and cons.

While not suitable for everyone, many prudent investors choose to allocate 5%- 30% of their retirement savings to precious metals like gold and silver.

Done carefully, a Gold IRA provides portfolio diversification, inflation hedging, exposure to a tangible asset, and tax optimization.

However, it does come with higher annual fees and less liquidity compared to traditional IRA investments.

By following the six steps outlined above, you can seamlessly execute a rollover or transfer to fund a Gold IRA account with an experienced precious metals partner.

Take time to research reviews and compare Gold IRA companies to find the right fit for your investment needs.

With a balanced retirement portfolio that wisely incorporates physical gold, you can take greater control, mitigate risk, and prepare more confidently for your financial future.

A Gold IRA could provide the stability your portfolio needs as you enter your golden years.