Are you considering investing in precious metals to diversify your portfolio and safeguard your wealth?

Among the most reputable companies in this space are Goldco and Noble Gold Investments.

Both have stellar reputations, offer a wide range of products and services, and make it easy to purchase gold and silver for investment purposes or to roll over your existing retirement accounts into precious metals IRAs.

So, how do you decide which company is the better choice for your needs?

In this comprehensive comparison, we’ll examine Goldco and Noble Gold — their key offerings, pros and cons, customer feedback and more — to help you make an informed decision.

Key Offerings

Both Goldco and Noble Gold offer direct sales of gold and silver (coins and bullion) that you can hold personally. They also allow you to roll over your existing IRA or 401(k) into a self-directed precious metals IRA.

The process is simple — they handle all the paperwork and work directly with your current custodian to transfer the funds.

Then, you can choose which IRS-approved gold, silver, platinum or palladium products you want held in your new precious metals IRA.

Goldco no longer has a minimum investment requirement, while Noble Gold requires a minimum of $20,000.

So, Noble Gold offers a slightly lower entry point.

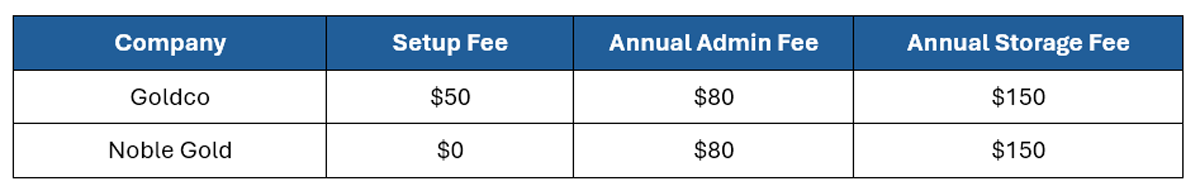

Both charge very similar fees, see the comparison table:

For precious metals IRAs, there is typically a one-time setup fee ($50), an annual maintenance fee ($80-$100), storage fees ($100-$150 segregated or $80-$100 non-segregated), and a small wire transfer fee.

Products

The two companies offer a very similar selection of common bullion coins and bars from mints around the world, including American Eagles, Canadian Maples, Austrian Philharmonics, South African Krugerrands and more.

The big difference is that Goldco offers a wider range of exclusive special coins with lower mintages and numismatic potential. Noble Gold sticks to bullion products.

Both companies guarantee the authenticity of their products and ship securely and fully insured.

Storage

By IRS rules, precious metals held in an IRA must be stored at an approved depository, not in your home.

They both have partnered with International Depository Services (IDS), one of the most respected high-security precious metals storage facilities.

IDS has locations in Texas, Delaware and Canada.

However, Noble Gold offers its own exclusive segregated storage vault in Texas in partnership with IDS for no additional cost — a nice extra perk.

Overall, your metals will be very safe and secure with either company.

Buyback Program

Another factor to consider is what happens when you want to liquidate some or all of your precious metals holdings.

Both Goldco and Noble Gold offer buyback programs, in which they will purchase your metals back from you with no extra fees or commissions.

However, Goldco claims they offer the “highest price” buyback guarantee and urge customers to come to them first before selling elsewhere.

That’s a strong vote of confidence in their buyback pricing.

Customer Feedback & Complaints

Reputation and trust are paramount when choosing a precious metals company.

Both Goldco and Noble Gold have very strong customer feedback, with hundreds of glowing reviews and 4.5 to 5-star ratings on trusted third-party sites like the Better Business Bureau (BBB), Business Consumer Alliance, TrustPilot, Google Reviews, and ConsumerAffairs.

Customers rave about the attentive, professional service, ease of the process, and helpful attitude of the reps.

However, there was a notable difference when we analyzed the BBB complaints over the last 12 months.

Goldco had 26 complaints compared to just 1 for Noble Gold. Goldco’s complaints revolved around confusion over sell spreads and pricing on buybacks or liquidations.

To put this in perspective, Goldco has been around longer and handles a higher volume of customers than Noble Gold. So, based on their size, more complaints are to be expected.

To their credit, Goldco made a good-faith effort to respond to and resolve all complaints. But it’s still an important difference worth factoring into your decision.

Expert Advisors

One area where Goldco really shines is its extensive library of free educational resources, guides and expert analysis.

They offer a comprehensive “Wealth Protection Kit”, regular blog and video updates, and detailed guides on topics like IRS rules for precious metals IRAs, red flags to watch out for, and how to avoid scams.

Compared to Noble Gold, Goldco goes more in-depth to educate customers and the public.

However, Noble Gold advisors tend to spend more time working one-on-one with each client to understand their unique goals, risk tolerance, timeline and budget.

Then, they provide customized guidance on which products are the best fit. Many customers express how patient, down-to-earth and low-pressure the Noble Gold team is.

You don’t get the sense of a corporate “one size fits all” approach but a boutique level of personal attention.

Goldco Pros

- No minimums on purchases

- Extensive educational resources, guides and market analysis

- Wide selection of exclusive specialty coins with numismatic potential

- Long track record in the industry

- “Highest price” buyback guarantee

- Free silver up to $10,000 offer for qualified accounts

- Recommended by Sean Hannity, Chuck Norris, Ben Stein and other well-known personalities

Goldco Cons

- More customer complaints about confusion over spreads/pricing when selling

- Slightly more “corporate” feel compared to Noble Gold

Noble Gold Pros

- Lower minimum investment of $20,000 for precious metals IRA accounts

- Offers exclusive segregated storage option at no extra cost

- Personalized “white glove” level of service

- Fewer customer complaints and positive feedback on the sales process

Noble Gold Cons

- No specialty/numismatic coins

- Less extensive online educational resources and guides

- Newer company without as long of a track record as Goldco

Both Goldco and Noble Gold share these key advantages:

- Straightforward process to set up precious metals IRA

- Competitive, transparent pricing and fees

- Work directly with your existing custodian to handle IRA rollovers

- Secure, insured shipping and storage at an IRS-approved depository

- Hundreds of 5-star customer reviews and strong BBB ratings

- Buyback programs to easily liquidate your metals holdings

- Knowledgeable, low-pressure sales reps and account executives

The main differences between Goldco and Noble Gold come down to minimum investment requirements, selection of specialty coins, extent of educational resources, storage options, and general approach to customer service (more “corporate” vs. “boutique”).

But both are reputable companies that make it simple and secure to diversify your savings with physical precious metals.

Final Verdict

Goldco and Noble Gold are both excellent choices for adding precious metals to your portfolio or retirement account.

They maintain the highest standards of ethics, transparency, and customer service in an industry that, unfortunately, has its share of bad actors and fly-by-night operators. You can invest with confidence in either company.

Goldco is better if you want a wider selection of special coins, value their extensive educational resources, and prefer a company with a longer track record. They also offer the flexibility of no minimum investment requirement.

Noble Gold stands out if you value exclusive segregated storage, a more personalized service experience, and a boutique approach. They also have a strong reputation with fewer customer complaints.

Whichever route you choose, Goldco and Noble Gold make investing in precious metals safe, simple and hassle-free.

They walk you through each step, handle all the paperwork, and deal directly with your existing IRA custodian to facilitate the rollover.

See how Goldco and Noble Gold Investments compare to other leading gold IRA companies — check out our detailed comparison table now.