When it comes to securing a comfortable retirement, many investors are exploring ways to diversify their portfolios and hedge against economic uncertainties.

One increasingly popular option is to rollover a 401k into a Gold IRA.

This strategy allows you to convert part or all of your 401k retirement savings into physical gold, which offers a unique layer of stability and diversification that stocks and bonds can't provide.

In this guide, we'll walk you through the 401k to Gold IRA rollover process, discuss the benefits and potential drawbacks, and answer some of the most frequently asked questions.

By the end, you'll clearly understand how to make this strategic move and why it could be a valuable addition to your retirement planning.

What is a Gold IRA?

Before diving into the rollover process, let's clarify what a Gold IRA is.

A Gold IRA, or Precious Metals IRA, is a self-directed Individual Retirement Account that allows investors to hold physical gold or other approved precious metals like silver, platinum, and palladium.

Unlike traditional IRAs, which typically hold paper assets such as stocks and bonds, a Gold IRA allows you to own tangible gold that you can touch and feel.

A self-directed IRA gives you more control over what you invest in, allowing for a wider range of assets, including real estate and precious metals, which aren't available in traditional IRAs.

Why Rollover a 401k into a Gold IRA?

If you're nearing retirement or simply want to protect your savings from market volatility, a 401k to Gold IRA rollover can offer several significant advantages.

Hedge Against Inflation

One of the biggest threats to retirement savings is inflation. As the cost of goods and services rises, the purchasing power of your dollars decreases.

Gold, however, has historically served as an excellent hedge against inflation. It tends to hold its value or even appreciate during periods of high inflation, which can help protect your retirement savings in the long run.

Diversification

Diversification is crucial to building a resilient retirement plan. By converting part of your 401k into a gold IRA, you're not putting all your eggs in one basket.

Gold has a low correlation with traditional assets like stocks and bonds, meaning that gold can often perform well when the markets are down. This helps smooth out the volatility in your overall portfolio.

No Counterparty Risk

Unlike stocks, bonds, or mutual funds, which rely on the performance of companies or governments, gold is a physical asset that holds intrinsic value.

It doesn't depend on a company's ability to pay dividends or a government's financial stability. When you invest in gold, you eliminate the counterparty risk that comes with other investments.

Safe Haven During Economic Uncertainty

Gold is often referred to as a safe-haven asset. During economic or political uncertainty, gold tends to perform well as investors flock to it as a stable store of value.

If you're concerned about stock market crashes, recessions, or geopolitical tensions, having a portion of your retirement in gold can provide peace of mind.

The 401k to Gold IRA Rollover Process

If you're ready to roll over your 401k into a Gold IRA, the process is relatively straightforward but involves a few important steps. Let's break it down:

1. Choose a Reputable Gold IRA Custodian

The first step is to choose a Gold IRA custodian—a financial institution that the IRS approves to manage your Gold IRA.

This is a critical step, as a reputable custodian will ensure that your assets are handled securely and in compliance with IRS regulations. Make sure to do your homework and research top-rated Gold IRA companies to find one that fits your needs.

💡Pro Tip: Look for a company specializing in precious metals and offering transparent fees to avoid later surprises. Many companies also offer educational resources to help you understand the process better.

2. Open a Self-Directed IRA Account

Once you've chosen a custodian, the next step is to open a self-directed IRA account.

This type of account gives you more control over the assets you invest in, including physical gold. Your custodian will guide you through the paperwork and account setup process, making it simple and straightforward.

3. Initiate the Rollover

Now, it's time to convert your 401k funds into your new Gold IRA. There are two options for this:

- Direct Rollover: In a direct rollover, your 401k provider sends the funds directly to your new Gold IRA custodian. This is the preferred method because it avoids any tax penalties and ensures a seamless process.

- Indirect Rollover: In an indirect rollover, you receive the funds from your 401k and must deposit them into your Gold IRA within 60 days to avoid taxes and penalties. While this method gives you temporary control of the funds, it's riskier because you could incur penalties if you miss the deadline.

4. Purchase IRS-Approved Gold

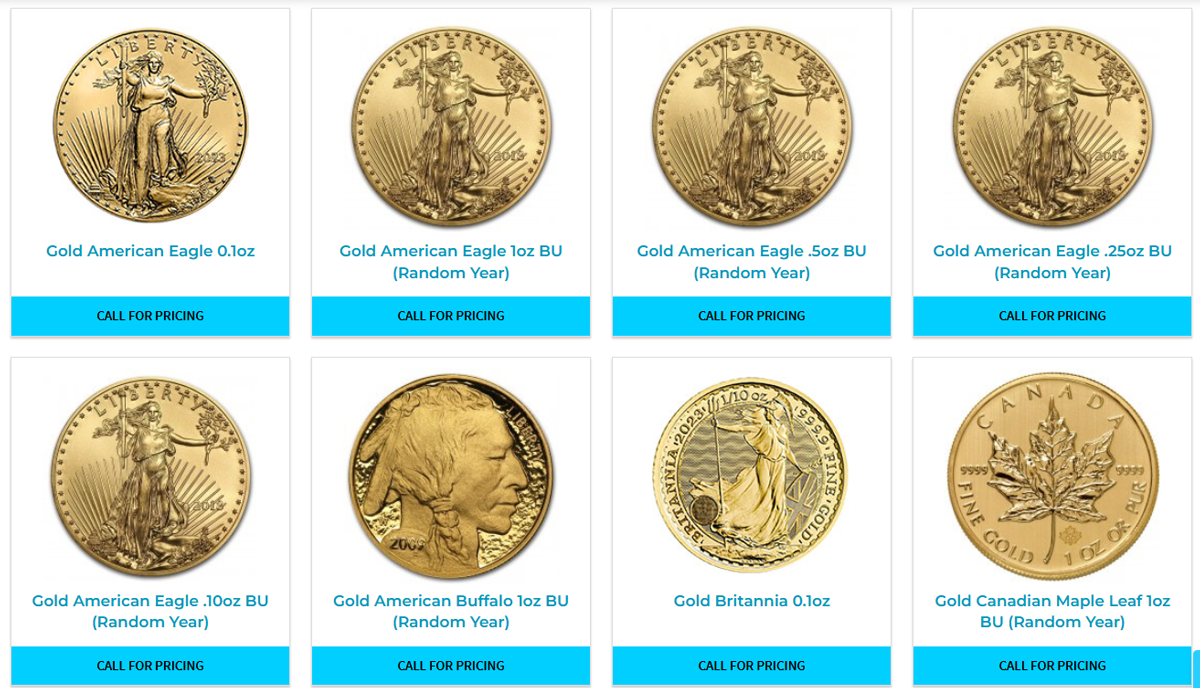

Once the funds are in your Gold IRA account, you can work with your custodian to purchase IRS-approved gold. The IRS has specific guidelines on the types of gold that can be held in a Gold IRA.

For example, gold must meet a minimum fineness requirement (purity level of 99.5% for gold bullion), and certain coins, like American Gold Eagles, are also allowed.

5. Secure Storage

Finally, the gold you purchase must be stored in an IRS-approved depository.

You cannot physically possess the gold while it is in your IRA. Instead, it will be securely stored in a depository, and you can rest assured knowing your investment is safe.

Benefits and Potential Drawbacks

Like any investment, rolling over a 401k into a Gold IRA comes with both benefits and potential drawbacks. Let's explore both sides so you can make an informed decision.

Benefits

- Tax Advantages: Just like a traditional IRA, a Gold IRA offers tax advantages, including tax-deferred growth or tax-free withdrawals, depending on the type of account you choose (traditional or Roth).

- Protection from Market Volatility: Gold can help protect your retirement savings from market downturns, acting as a balance when stocks or bonds are underperforming.

- Long-Term Stability: Gold has been used as a store of value for thousands of years and remains highly valued across the globe.

Potential Drawbacks

- Storage Fees: Since physical gold must be stored in an IRS-approved depository, you'll need to factor in storage fees, which can add up over time.

- No Dividends or Interest: Unlike stocks or bonds, gold doesn't pay dividends or interest. Its value is tied solely to market demand and price appreciation.

- Liquidity: While gold is a highly liquid asset, selling your gold from a Gold IRA can involve additional steps compared to selling stocks or bonds.

FAQs About 401k to Gold IRA Rollovers

Can I rollover any 401k into a Gold IRA?

Most 401k plans from past employers are eligible for a rollover into a Gold IRA. However, if you have a 401k with your current employer, you may need to check with your plan administrator to see if a rollover is allowed.

Will I incur taxes or penalties for rolling over my 401k into a Gold IRA?

As long as the rollover is completed correctly, either through a direct rollover or within the 60-day window for an indirect rollover, you won't incur any taxes or penalties.

What types of gold can I hold in a Gold IRA?

The IRS has specific guidelines on what types of gold are allowed in a Gold IRA. You can invest in gold bullion, coins, and other precious metals, but they must meet minimum purity standards.

Can I take physical possession of the gold in my Gold IRA?

No, IRS regulations require storing the gold in an approved depository. You won't have direct access to the gold while it's part of your IRA.

Ready to Make the Move?

If you're considering a 401k to Gold IRA rollover, now is the time to take the next step.

When done properly, this strategy can provide you with a solid hedge against inflation, help you diversify your retirement portfolio, and offer peace of mind during uncertain economic times.

Looking for help to get started? Check out our Top 5 Gold IRA Companies to find the right partner for your rollover. Make sure your retirement is as golden as possible!